While stock market fluctuations may seem random or illogical, behavioral economics can help us understand how the stock market works. Traditional financial theories often assume that investors make informed choices based on clear information. However, the real market is different. Price fluctuations stem from emotional fluctuations, herd behavior, fear of loss, or overconfidence. These human instincts form recurring patterns. Behavioral economics connects psychology and finance and shows that cognitive biases and emotional responses have a much greater impact on stock market movements than objective facts. Understanding these market-influencing factors enables investors to make informed choices.

How Human Psychology Influences Market Fluctuations

Stock market movements are not determined by figures but by the choices of millions of individuals. When people are optimistic about the market outlook, they buy more shares, causing prices to rise. Conversely, when people panic, increased selling pressure causes the market to fall. These emotions don’t always stem from objective, long-standing facts; they can stem from current events, rapid market changes, or personal experiences. Behavioral economics posits that people are often guided by emotions rather than rational thinking and that these emotional reactions spread quickly throughout the market. The theory helps investors realize that market trends are often merely psychological fluctuations, not signals of significant economic shifts.

How Herd Behavior Influences Stock Market Trends

Herding behavior has a significant impact on market movements. Investors often blindly follow the crowd because they believe the majority must be right or because they don’t want to miss opportunities. When many people buy a stock, the price can rise rapidly, even if the company’s fundamental value hasn’t changed. This can lead to market bubbles. However, when people start selling out of fear, the urge to sell increases, and the price falls. Behavioral economics shows that herd behavior is influenced by social pressure, uncertainty, and the fear of making decisions alone. This helps investors realize that many stock market patterns are not based on hard facts but on group psychology.

How Overconfidence Influences Market Movements

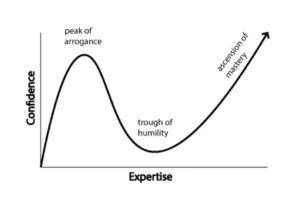

Investors often take risks out of overconfidence, which increases market volatility. When people think they can easily predict market movements, they may buy heavily, trade frequently, or take excessive risks. Overconfident investors often believe they can identify profitable trades or avoid losses, when in reality, they cannot. This behavior leads to rising stock prices in bull markets and exacerbated losses in bear markets. Behavioral economics posits that overconfidence leads to overreaction, which further fuels market volatility. Understanding this process helps investors remain rational and avoid being influenced by the excitement or optimism of others.

Loss Aversion and Its Impact on Market Trends

Loss aversion refers to the tendency to fear losses more than to enjoy gains. It has a significant impact on the stock market. When prices fall, investors fear losses and sell quickly, even if the decline is temporary. This emotional selling accelerates the market decline. Loss aversion also leads investors to hold onto stocks too tightly during market rises. They do this to avoid small losses but miss larger opportunities. Behavioral economics shows that this emotional bias leads to market overreactions, accelerating price declines and prolonging recovery times. Understanding loss aversion helps investors avoid making judgments based on panic.

The Anchoring Effect and Its Impact on Market Behavior

When investors overrely on certain reference points, such as historical stock prices, previous market peaks, or recent trends, they are in a state of “anchoring.” This bias influences people’s perception of current market conditions. For example, even if conditions within companies change, investors may believe that stock prices will rise to higher levels. People can also miss important market signals by focusing too much on a single piece of information. Behavioral economics shows that the anchoring effect changes the way people perceive things and influences market trends by leading them to make false assumptions. Understanding the anchoring effect allows investors to view the data they currently have more objectively.

Market Bubbles and Behavioral Patterns

Stock market bubbles occur when psychological factors drive stock prices far above their true value. This often happens when people are overly enthusiastic, excessively excited, and blindly follow the crowd. People keep buying because they believe prices will continue to rise, even when they don’t. Behavioral economics suggests that bubbles often stem from greed, overconfidence, or the fear of missing out. These bubbles burst when investors realize that prices can’t remain constant forever, causing a price crash. Investors should avoid buying at inflated prices and prepare for market declines by understanding the psychological processes that lead to bubbles.

Conclusion

Behavioral economics demonstrates that human psychology has as much of an impact on stock market trends as financial data. Emotional reactions, cognitive biases, and herd behavior create patterns that drive market movements. By understanding these psychological factors, investors can make more informed decisions and avoid common mistakes made due to fear, enthusiasm, or overconfidence. Understanding people’s behavioral patterns helps investors focus on long-term goals and reduce emotional decision-making. Behavioral economics can help everyone become a better and more successful investor.

FAQs

1. What is the relationship between behavioral economics and stock market trends?

It examines how emotions and psychological biases influence investors, leading to trends that don’t necessarily reflect the actual state of the economy.

2. Why do investors follow the crowd?

People tend to trade in groups because they feel more secure and don’t want to miss opportunities that others seize.

3. What are the most important psychological factors that influence markets?

Fear of loss is one of the most powerful factors influencing market movements because it leads people to sell quickly, exacerbating market volatility.

4. Can behavioral economics help us predict market trends?

It can’t accurately predict market trends, but it can help you understand why certain patterns exist and prepare investors for common emotional reactions.

5. How can behavioral economics help you invest?

It can help investors recognize their own emotional biases, make more informed choices, and focus on long-term financial goals.